Sell Horses Online

Reach Thousands of Buyers with PasturePost

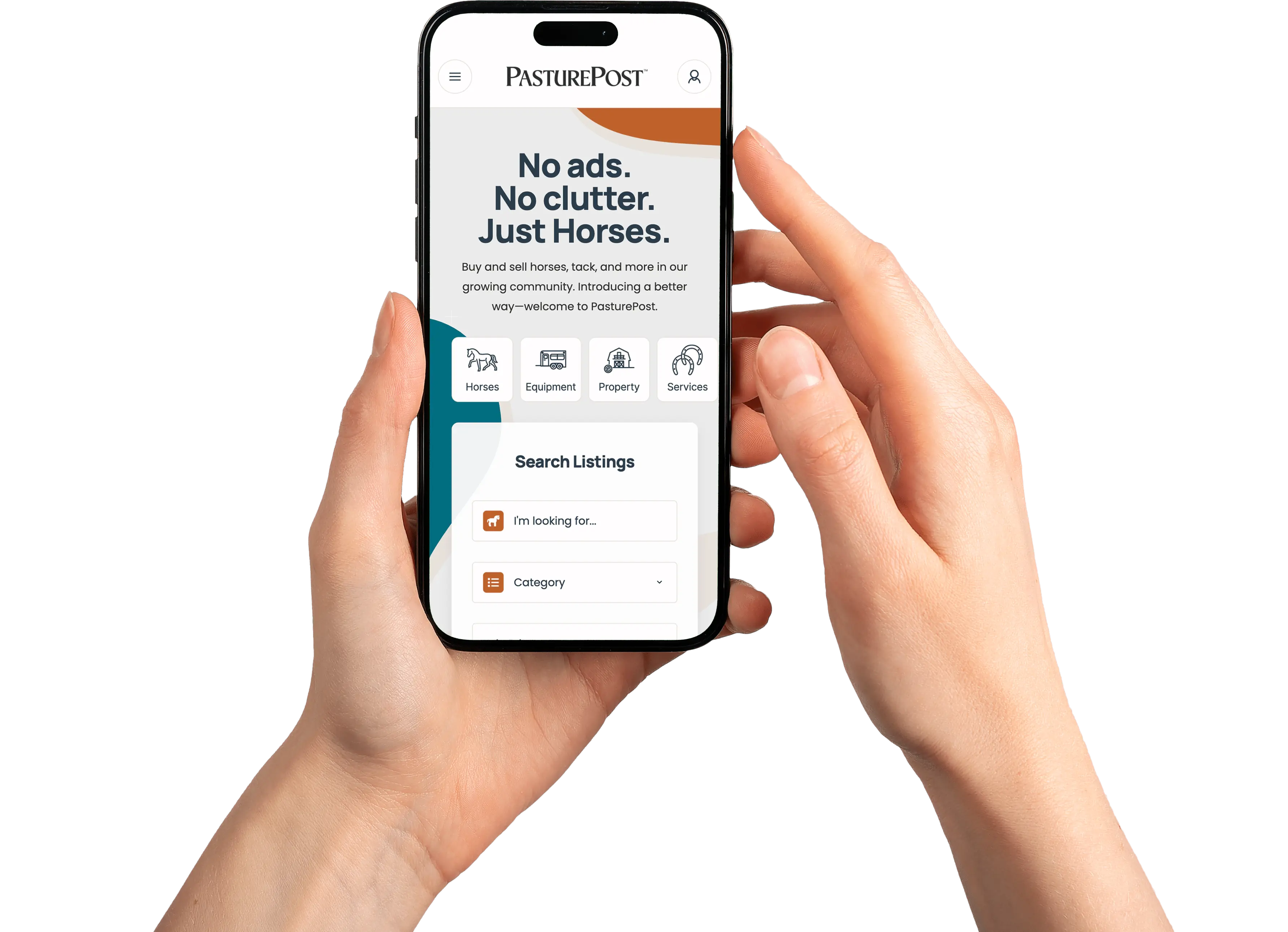

PasturePost is the ultimate platform for selling horses online. Create listings in minutes, showcase your horse, and connect with an engaged equestrian audience.

Why Choose PasturePost?

- Easy-to-use tools for detailed horse listings

- Access to a nationwide network of buyers

- Optimized platform for horse sales

- Designed to help sellers stand out

List Your Horse Today

Start selling your horse online now. Visit PasturePost.com and connect with serious buyers today.